Goodbye service charge, hello 'admin fee'

Plus: The difficulty of sourcing live snails for a London restaurant and a personal tribute to one of London's leading American candy shops.

Hello and welcome to London Centric. Thanks to all the readers who entered our competition to win the TROWEL OF TRUTH off the back of this week’s story about phone thieves burying stolen devices in flowerbeds.

Readers have also flooded our inbox with the locations of other phone stashes across the capital. Given we’re able to rapidly assemble a crowdsourced map of device drop points, you don’t have to be one of those online influencers who make a living out of talking down London to think that it would be helpful if the police were doing something similar.

Today we’ve got a story about why the service charge on your restaurant bill might be replaced with an ‘admin charge’ — scroll down to read it.

London Centric’s journalism is supported by paying readers. Thank you so much to everyone who makes it possible!

The “admin charge” coming to London restaurants that circumvents the new law on tipping

By Polly Smythe

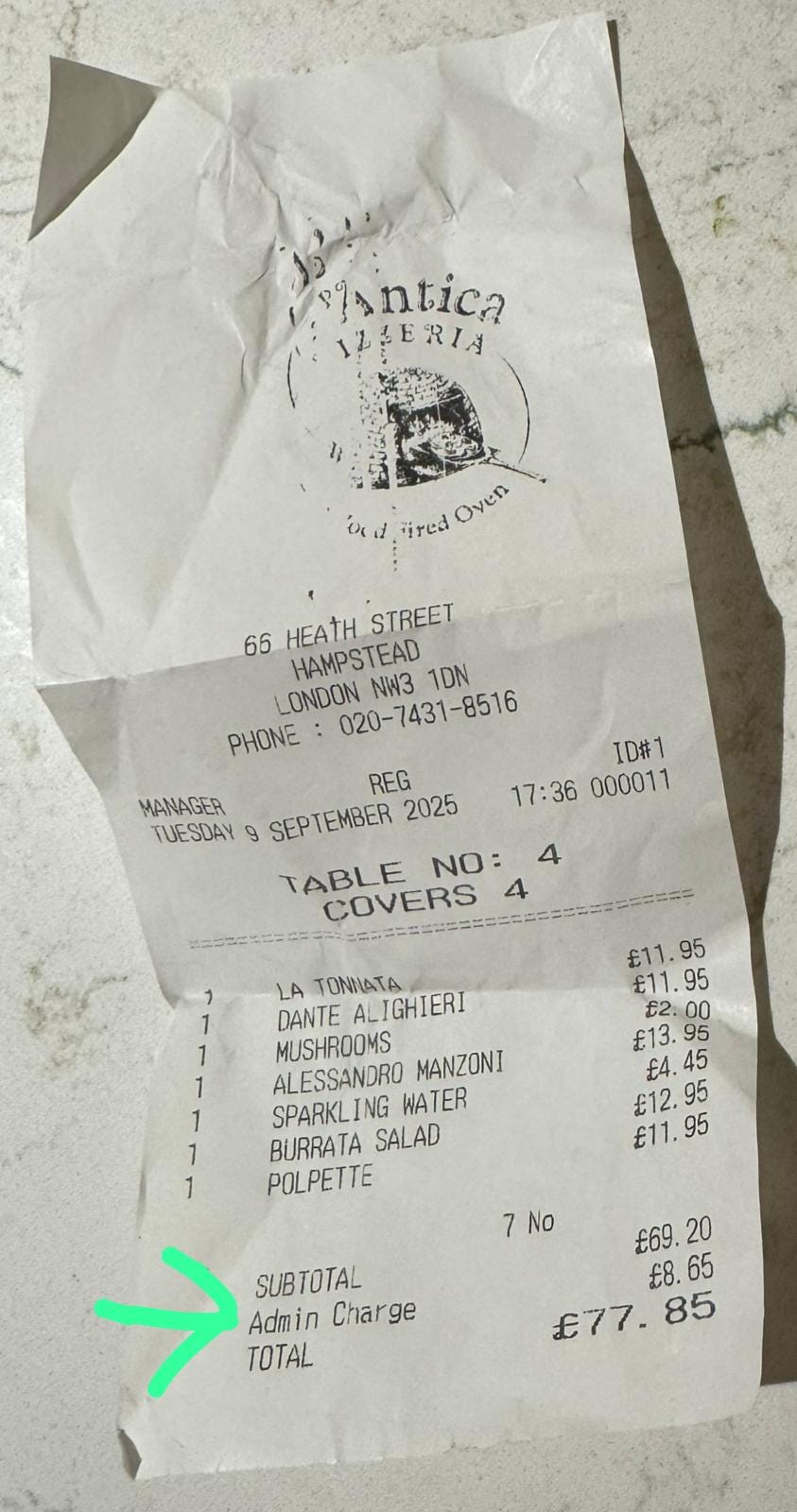

If you go for a meal at L’Antica Pizzeria, an Italian restaurant with branches in Hampstead and High Barnet, you might find a 12.5% “admin charge” added to your bill. It looks a lot like a service charge and it is the same percentage cut as many service charges. But there’s one key difference — the different name means it doesn’t have to go to staff.

When one London Centric reader dined there recently, the fee took their meal from £69.20 to £77.85. When the diner asked the waiter what it was for, they were told it was to “cover the cost of the card machine and general restaurant costs.”

This is just one of the more brazen attempts to sidestep a new law requiring restaurants to pass tips to their staff in full, as restaurant owners try to remain financially viable in the face of rapidly-increasing costs. When London Centric paid a visit to L’Antica, the restaurant manager told us she wasn’t authorised to talk to us about the admin charge. Our follow-up emails went unanswered.

“No matter what senior management call it, customers will assume that this charge is a tip that should go to workers but it won’t,” said Bryan Simpson, who leads on hospitality for the Unite union. “That is completely disingenuous and almost certainly a breach of the Fair Tips Act, at least in spirit if not the letter of the law.”

Whether it’s “admin fees” or extra charges for “linen” and “ambience”, it’s no longer a given that a restaurant bill is what you’ve ordered from the menu plus an optional service charge that goes to the people who served you. As drinking and dining out becomes more expensive, we take a look at the extra charges being added to London restaurant bills – and whether these new charges risk eating into staff tips.

Did you enjoy the taste of your “brand fee”?

L’Antica is far from the only restaurant in London sneaking things onto the bill: luxury department store Harrods slaps on a £1 cover charge at its restaurant, while the Wolseley charges a cover fee of £2. Before shutting down in the summer, dim sum chain Ping Pong was charging diners a 15% “brand fee.”

A meal at one of Richard Caring’s spots such as Sexy Fish, Scott’s or J Sheekey comes with a £2 per person cover charge. Bacchanalia, Caring’s restaurant dedicated to “Greco-Roman” feasting, uses the term “ambience fee” to describe its cover charge. London Steakhouse Company, co-founded by Marco Pierre White, charges each diner a £1.50 charge for linen. Mayfair’s Jamavar adds a 10% “cover charge” alongside the 5% service charge that has to go to staff.

Matt Paice, who co-owns the Michelin-starred African restaurant Chishuru, doesn’t engage in such tactics and has an optional service charge that is divided amongst the whole team. But he told London Centric that even the high end of London hospitality is being hit hard: “I had lunch [this week] with a pair of operators who have five restaurants and two Michelin stars, and I complained about how tough the market feels, and they said they don’t know any operator who doesn’t feel exactly the same way. Expansion plans are being shelved and new hiring is being frozen across the capital. Even the restaurants catering to the 1% are struggling.”

In this difficult climate, many restaurants have simply shut up shop. But for those fighting to stay open, spiralling costs present a conundrum: incorporating them into the headline price of a dish on the menu risks putting diners off.

Mandy Yin, who runs the popular Malaysian Sambol Shiok Laksa bar on Holloway Road in north London, told London Centric she has taken a different approach. “We aren’t charging any fees other than for no show/late cancellation fees and discretionary service charge,” said the outspoken defender of the London restaurant industry, who has detailed the financial challenges she and others are facing. “We have held prices this year but fractionally decreased portion sizes to allow this to happen – we did this to avoid putting prices up.”

“Operators thought nothing of dipping into the service charge pot”

It was the previous Conservative government that passed legislation to ensure that customers’ tips and service charges made their way directly to staff. The Tipping Act 2023 states that by law employers must pass on tips to workers without deductions, other than usual tax and National Insurance, and share these tips between staff in a fair and transparent way.

Paice, the co-owner of Chishuru, said these changes are partly behind the appearance of these new charges on London restaurant bills: “Prior to last year’s tipping laws, operators thought nothing of dipping into the service charge pot to make ends meet, but that’s now verboten.”

Initially proposed in 2016, it took eight years for the legislation to pass and it was celebrated as a victory for serving staff.

Instead, Unite’s Bryan Simpson said the first year of the Tipping Act has shown that legislation is not enough to protect the principle that workers’ get any extra charges on bills: “The decision of far too many restaurants and bars to effectively deny workers tips by cynically changing the service charge to an ‘admin fee’ or ‘brand charge’ in order to circumvent well established fair tips legislation is one of the most blatant examples of tips theft that we’ve come across as the union for restaurant and bar workers.”

Paice said that while his venue does not have an admin charge, he can see why some restaurant owners have ended up adding one: “Costs are soaring and wages are soaring, but no one wants to increase menu prices for fear of scaring customers away. The sneaky way round? Add a fee to the bill that’s small enough for customers not to fight it. Is it any worse than mid-market casual dining chains charging 13.5% for bog-standard service? I’m not sure.”

IN MEMORIAM: Kingdom of Treats (2022-2025)

London Centric is sad to announce the closure of Kingdom of Treats, central London’s leading tax-evading American candy shop. It was three years old. The cause of its closure is unknown.

The shop, based in the Trocadero Centre overlooking Piccadilly Circus, exploited tens of thousands of customers in its short life by selling wildly overpriced sweets to passing tourists. In an era when ‘experiential shopping’ is all the rage, Kingdom of Treats went out of its way to elicit an emotional response from its customers. It did this by failing to display many of its prices until purchasers reached the till, at which point people were too embarrassed to back out of paying the best part of a tenner for a pack of Haribo.

Often dismissed as a front for money laundering, London Centric’s reporting showed how the reality was that £660 an hour flowed through Kingdom of Treats’ tills. Very little of it appears to have made its way to the taxman.

The shop was often confused with Kingdom of Sweets, a much larger American Candy chain with a remarkably similar logo and operating model. Yet Kingdom of Treats had a unique claim to fame: In a curious coincidence, its two branches in London and Edinburgh existed only in properties owned by a company controlled by the billionaire landlord Asif Aziz. Both shops have now closed following our questions about their tax affairs.

For those concerned Criterion Capital may be moving upmarket with its new tenants, there is no reason to fear: Kingdom of Treats’ London branch was this week replaced by another tacky gift shop.

RIP: Kingdom of Treats 2022 - 2025. It is survived by millions of pounds in unpaid taxes that may never be recovered.

Mo’ snails, mo’ problems

One element was missing from our big investigation into London’s tax-dodging snail farms: Who is the landlord getting out of paying hundreds of thousands of pounds in taxes by letting out their office building to snail farms?

The answer, we can reveal, is Iraqi businessman Namir El-Akabi, who made a fortune from contracts with Western governments in the aftermath of the 2003 invasion of his home nation. After growing up in exile he returned to Baghdad within days of Saddam Hussein being toppled with an eye to making his millions. According to a New York Times profile entitled “The Hot-Money Cowboys of Baghdad”, he specialised in winning vast US army contracts providing catering, fuel and construction services before moving into the business of supplying armed guards to oil companies. This quickly became an international conglomerate called Almco.

After just three years of winning Western contracts in Iraq he was able to spend £32m to purchase Winchester House on Old Marylebone Road, conducting the transaction through a company based in an off-shore tax haven. While Winchester House’s former tenants include the Embassy of South Sudan, it is now being used as a mollusc breeding centre.

El-Akabi’s other business interests have included running private militias for oil companies. The billionaire and his company did not respond to multiple requests for comment from London Centric on what first attracted them to the capital’s snail farming scene.

Yes but what if you do actually need some snails?

Reader Isaac McHale, the owner of east London’s two-Michelin-starred restaurant The Clove Club in the old Shoreditch Town Hall, has been in touch to raise the very real issue of sourcing live snails for his restaurants. It turns out last year the chef had contacted Terry Ball’s Lancashire snail hatchery, the same people who are breeding gastropods in El-Akabi’s office block. He’d hoped to obtain a supply of land-based molluscs for his new Bar Valette venue — but never got a response.

“Normally snails are sold cleaned,” explains McHale. “You have to purge snails for three days by letting them fast to clean out their digestive tract, then you have to ‘de-slime’ them, then cook in a stock. Most snail suppliers do all that hard work for you and you buy deshelled snails.”

He said this leads to mass production of frozen snails for human consumption: “But I wanted live snails in their shells, to cook and serve like I have eaten across Spain.”

He repeatedly contacted Ball’s operation but had no reply to emails, calls or texts: “I didn’t think this was a tax scam, I thought it was a little job that a farmer had tried and abandoned.”

Instead he now sources live gastropods from a Lithuanian woman in Northern Ireland. His diners are offered a bowl of snails in their shell that have been cooked in aromatic stock with pigs trotters, paprika, celery, chorizo, white wine and tomatoes. Is Westminster council missing a trick? Could there be a genuine demand for inner-London snail farms waiting to be unlocked in the name of economic growth?

Snails as the harbinger of the next financial crisis

Two final takes on parable of the snail farms. One comes in the form of an extraordinary spoken word podcast by Ireland’s Blindboyboatclub ruminating on aspects of our story, among other matters of life and bicycles.

Another very different take comes from free marketeer commentator Matt Kilcoyne, who argues snail-based tax avoidance is actually an indicator of an impending London commercial property crash: “These are landlords desperately trying to avoid admitting their properties have collapsed in value… The problem grows larger while everyone pretends it’s about tax avoidance rather than the slow-motion repricing of a commercial property sector that fundamentally changed in 2020 but cannot admit it without triggering financial crisis.”

London Centric will return next week with slightly fewer stories about snails. Although if anyone knows which commercial building in the borough of Barnet is possibly also being used as a snail farm then we’d love to know because the council won’t tell us.

Please get in touch via email or a WhatsApp with anything else you think we should look into.

What I think was interesting about the tips story is that things really do seem to be very very tough for restaurants and it doesn’t seem to be special pleading. Squaring increased staff costs with customers who are guided by the list price on dishes leads to additional charges after the event to make up the difference, or a financial loss. Obviously things are different if you’re Richard Caring and your clients barely even glance at the bill.

God I hate this shit, as a bartender I rely on service charge to pay rent. After the law went through to guarantee service charge going to staff a lot of venues dropped their wage to below London living wage and instituted a “guaranteed service charge” system to make the difference. I know wage costs are high but staff also need to be able to afford this city