The real reason London pubs are putting service charges on pints

Plus: Preposterous London property of the week, Lime insists its e-bikes don't pose a threat to your legs, and Transport for London pays for 24/7 security to keep the homeless away from Park Lane.

For the last few weeks London Centric has been doing the heavy lifting of visiting pubs across London and trying to understand why they’ve started adding a 4% service charge to drinks bought at the bar.

While some other news outlets this week reported that the Well & Boot in Waterloo station has been indulging in this practice, we can reveal that it’s already been enacted in at least eight other pubs in the capital.

More intriguingly, the driving force appears to be an attempt to sidestep increased taxes on employers introduced by chancellor Rachel Reeves.

Scroll down to understand what’s going on.

Thanks to all the readers who got in touch about last week’s story about Asif Aziz’s Criterion Capital and the threat posed to the Picturehouse Central cinema near Piccadilly Circus. If you missed it, do read it here.

If you’re able to support our work then every paying subscription really does make a massive difference when it comes to holding the powerful to account and ensuring that, unlike other media outlets, we are not beholden to vested interests.

The tip of the iceberg: Why service charges on pints have arrived in London pubs.

Nine London pubs run by hospitality chain Glendola Leisure have introduced an automatic service charge on drinks ordered at the bar, in a further example of American-style tipping culture making its way into the UK.

While this week the Telegraph spotted the introduction of the surcharge at the company’s Waterloo station pub, what hasn’t been reported is the scale of the issue and why the policy has been implemented.

Essentially, rather than put up the headline price of a pint, Glendola Leisure is choosing to add an “optional” service charge in a manner that enables it to increase staff income while sidestepping the government’s recent national insurance tax hikes.

Joe Rowsell, an employment tax expert at chartered accountants PKF Francis Clark, told London Centric that the service charge “would not be subject to national insurance” in the same way as a pay increase would be.

He added: “You’re almost saying to people, if you come and work for us, you’ll get a little bit more.”

Another leading London pub operator told London Centric they are watching with interest and considering implementing similar changes, given the financial challenges faced by the hospitality sector in recent years.

How a 4% price increase on a round of drinks usually works.

A pub puts the “official” price of a £40 round of alcoholic drinks up by 4%, leaving the customer to pay £41.60.

Of that £1.60 price increase the pub would have to pay 20% in VAT sales tax to the government, deducting 27p.

If the landlord wanted to pass on the remaining money in the form of staff wages they would have to pay employer’s national insurance. This tax was recently raised by chancellor Rachel Reeves to 15%, deducting a further 19p.

Once taxes are accounted for there would be £1.13 remaining of the £1.60 price increase that could go to staff in the form of increased wages.

How Glendola Leisure is arranging its “optional” 4% service charge on a round of drinks.

A pub charges £40 for a round of alcoholic drinks then applies an automatic “optional service charge” at the bar, leaving the customer to pay £41.60.

No extra VAT is due as long as the service charge is truly optional and can be removed on request.

No employer’s national insurance is due, with the landlord having no involvement in the distribution of the service charge.

The full £1.60 price increase can go to staff through the tipping system without the company paying tax on it. This means 42% more money from the price increase is available for staff compared to the other option. This system also means staff are incentivised to ensure customers do not remove the service charge. Employees still have to pay personal income tax on tips but receive a higher gross income.

When London Centric visited the Crown & Anchor in Covent Garden the bartender added the charge to the bill without saying anything. A single small sign further down the bar, which we only saw when we moved down after paying, informed customers: “An optional 4% service charge will be automatically applied to all Food & Drinks.”

Glendola operates nine pubs across London in prime locations:

The World’s End in Camden

The Fox in Shoreditch

The Lansdowne in Primrose Hill

Waxy O’Connor’s in the West End

Waxy’s Little Sister in the West End

Barley Mow in Westminster

Crown & Anchor in Covent Garden

Prince Alfred in Bayswater

Well & Boot in Waterloo station

Staff at all pubs said they added an automatic service charge of either 3% or 4% to all orders unless customers asked them not to.

Reena Sewraz, a money expert at consumer organisation Which?, told London Centric that while tip suggestions are an increasingly common sight on pub card readers, the automatic addition of service charge without asking customers first is “concerning” and lacks transparency.

Even if such charges are described as optional, they “can put [customers] in an awkward position where they may feel under pressure to pay the whole cost”, she explained, adding: "The law says that businesses should be clear about how they present the total price to customers. If charges are added to the bill automatically, it is hard to see how this can be the case.”

A spokesperson for Glendola Leisure told London Centric the tipping system has been introduced so that “guests can recognise the whole team’s service, bar, floor and back of house, in a single optional line”.

They said all the money goes to staff via an independent tronc, a technical term for a system used for allocating tips among hospitality staff: “We flag it clearly at the bar and on every menu in venue and online, and if a guest prefers not to pay it, we remove it immediately. Because it’s discretionary, it isn’t part of our prices and is never mandatory.”

Glendola added: “Our venues are cashless, and as society has moved away from cash tipping, which used to be a meaningful part of hospitality workers income, the service charge helps ensure our teams still receive gratuities for great service. Collecting gratuities by card and distributing them through an independent tronc is transparent, reliable, and tax efficient for staff under HMRC rules, helping tips reach our people promptly and fairly. Given recent government increases to employer national insurance, this system is also the most cost effective way for our staff to receive gratuities.

“Where a discretionary service charge is used across our venues, it works in exactly the same transparent, staff only way. In a challenging climate for hospitality, this helps us look after our teams and keep delivering great experiences for guests.”

Correction: The example in this piece originally miscalculated how much VAT is payable on a price rise. This has been fixed, with many thanks to the reader who pointed it out.

Lime bike corner: The e-bikes that Londoners hate to love.

After last week’s story of the London Centric reader who managed to get an insurance payout from Lime after losing (most of) his kidney in an e-bike accident, here’s the latest on what you need to know about the company behind the incredibly popular vehicles.

MyLondon spoke to a student who claims her Lime bike jolted forward while adjusting her hijab, leaving her leg smashed. Meanwhile the Telegraph has spoken to a trauma surgeon who said they constantly see leg breaks caused by the e-bikes in their hospital.

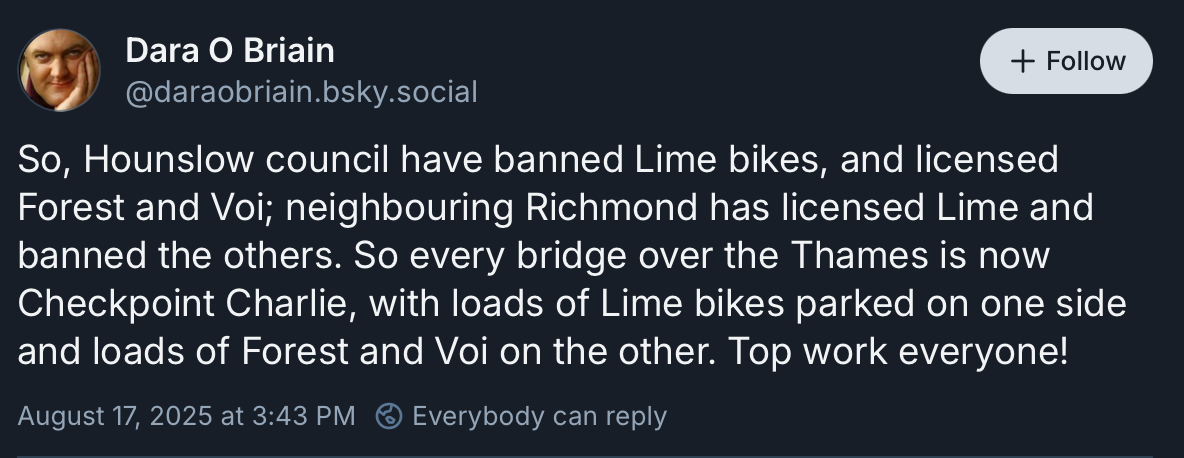

Intriguingly, both articles contain a new PR line from a Lime representative directly confronting claims by London Centric about the risk of ‘Lime bike leg’. Lime confidently told the publications: “Our data shows no identifiable trend relating to leg injuries among Lime riders in the UK.”Hounslow council in west London has de facto banned Lime from its streets, causing chaos on the borough’s boundaries as e-bike riders suddenly have to abandon their rides. The story was broken by local news reporter Dara Ó Briain, who had a previous career as a prominent comedian.

It’s another example of the regulatory chaos surrounding the capital’s e-bike companies, with both Sadiq Khan and Transport for London largely powerless to regulate them, forcing councils doing it on an ultra-local level.

Last week taxi firm Uber increased its holding in Lime’s UK operating business to more than 25% of the shares, according to a legal declaration filed at Companies House, showing the role of big money investors in the company. This is one of the few things we do know about how Lime works as a business, given the lack of regulation. There’s not even any official number on how many Lime bikes are active on the capital’s streets — or anyone with the power to make Lime disclose data on injuries.

Preposterous London property of the week

This black mould-infested Mayfair townhouse, currently owned by relatives of the Qatari royal family, has recently been reduced to a mere £7.95m. That’s a steep hit on the £11.6m the four Qataris — Noor Al-Thani, Aisha Al-Thani, Alanoud Al-Thani, and Dana Al-Thaniqa — paid for the property in January 2014.

The ceilings may be falling down, but according to the estate agent that creates “an ideal canvas” for the new owners of the “thoughtfully arranged” Mayfair property, the listing says optimistically. There’s also a surprisingly intact floating staircase.

The Park Street house is located just a few doors away from the Italian businessman who was ordered to fill his house with concrete after building an illegal basement – a useful reminder not to take the artistic licence of that “ideal canvas” too far without the necessary planning permission.

Exclusive: Transport for London pays for round-the-clock security to stop homeless people returning to Park Lane.

Transport for London is funding 24/7 security to prevent homeless people from forming a new encampment in the middle of Mayfair’s Park Lane, London Centric can reveal.

In May, the transport body obtained a court order to dismantle a previous encampment, located on a TfL-owned patch of grass in the middle of the road, between Hyde Park and multiple 5-star hotels. The location is just a short walk away from the abandoned mansion featured above.

Since then, TfL has paid for the private provider MEC Security to patrol the site full-time, together with a guard dog, to prevent homeless people returning, according to a Rottweiler-wielding security guard and a hotel employee.

Although the luxury hotels in the vicinity encouraged the removal of the former encampment, they did not contribute to the cost of the security because the land belonged to TfL, the hotel employee added.

A TfL spokesperson said the busy road was “not a safe place for people to sleep rough and our focus has always been on the safety and welfare of everyone involved.”

“People who have been sleeping rough at this site have been made aware that returning to the site is not an option and that they will be removed. We will continue to work with Westminster City Council whose outreach teams can connect people to the support available to them and prevent them from returning.”

If you want to get in touch with London Centric then message us on WhatsApp or email — or click below to leave a comment.

Can't see pubs lasting much longer if this carries on. A G&T in my local, trendy East London pub is already almost £8 - for a stingy UK measure of gin barely bigger than a tablespoon, it's absolute joke.

Lime Bike regulation is included in the forthcoming English Devolution and Community Empowerment Bill. Clauses 18 - 20.