What a French lunch discount card tells us about London fare dodging

Plus: When are we getting al fresco summer dining in the centre of the capital — and the bale of hay dangling from a London bridge.

Half of the city might be away on holiday but we’re continuing to beaver away on a series of investigations. You’ll see the fruits of our labours very soon.

But for now, scroll down to read about the latest front in the war against London’s fare dodgers.

If you want to get in touch with London Centric directly then message us on WhatsApp or email.

Anyone for al fresco autumn?

Earlier this year Sadiq Khan promised Londoners an al fresco dining revolution which would allow “Londoners and visitors to make the most of the capital’s summer months” and “boost the capital’s hospitality industry this summer”. The good news for fans of outdoor dining is that it’s still on the way to the West End this year. The bad news is that you might need a blanket to keep you warm.

Restaurant managers on St Martin’s Lane near Trafalgar Square told London Centric they had been instructed not to disclose the timetable for the proposed pedestrianisation scheme. However, a licence application confirms the summer pilot scheme on the street will run from 22 August to 31 October — somewhat missing the summer peak. Still, the street will be car-free from 11am to 11pm, with outdoor dining licences available for up to 34 businesses.

The St Martin’s Lane scheme, along with others in Shoreditch, Brixton, and Leyton have been funded with a £300,000 in one-off City Hall grants to local councils. In the future the mayor will take powers over outdoor dining away from local boroughs, meaning more pedestrianised dining streets could be coming — eventually.

Property developer stabbed to death was due to face trial over affordable housing claims

A Bermondsey property developer who was killed alongside his son in a knife attack at his south London office on Monday was due to appear in court over alleged breaches of affordable housing regulations, London Centric has learned. There is no indication the events are linked.

Terry McMillan, 58, was pronounced dead at the scene on Long Lane earlier this week. His son, Brendan, 27, later died in hospital. A 31-year old man has been arrested on suspicion of murder. There was a light police presence outside the building on Wednesday morning as investigators exited the office block, located on a busy road heading towards Borough station.

At the end of last year Camden Council stopped the sale of two flats in John Kirk House, Holborn pending a trial that was due to feature McMillan. The council alleged two companies controlled by McMillan had “sought to work around legally agreed safeguards to sell the homes for a profit”, even though they were required to be social housing. The issue was due to be dealt with at a high court trial.

The deceased property developer had previously faced litigation from Southwark Council over similar breaches of social housing rules. In 2021 he was sued for damages by a homeowner who was reported by Inside Housing to have said they were “deceived” into spending £714,350 on a former shared ownership flat despite it being restricted by affordable housing regulations. At the time, McMillan said “there was never any intention to harm the purchasers”.

Three things to know:

Why it’s hard to sell a £5m mansion in Mayfair. Neal Hudson, leading property analyst and friend of London Centric expands on the theory he set out in our investigation into the capital’s Omaze house. He argues in the Financial Times that the numbers don’t add up on buying high-end London property. Which is why it might be easier to offload them in online charity raffles.

London’s inner city boroughs have claimed they could go bankrupt if the central government pushes ahead with a new funding deal for local authorities. Twelve council leaders are today asking the government to review the data underpinning its proposed “Fair Funding Review”, arguing it fails to asses the real level of deprivation in the capital caused by high rents, which leave a quarter of London households in poverty after housing expenses. It comes amid growing grumblings among local Labour politicians that the central Labour government is taking the capital’s support for granted.

Why there’s a bale of hay hanging from a bridge in Barnes. Port of London bylaws dictate that whenever there is a height restriction beneath a bridge over the Thames, a bale of hay must be dangled to warn those passing below. Ian Visits, a chronicler of this curio, justifies the continued use of this approach: “Do you think spending £20-£30 a year on a bale of hay on random occasions is going to be more expensive than paying the lawyers to change the law that requires it?”

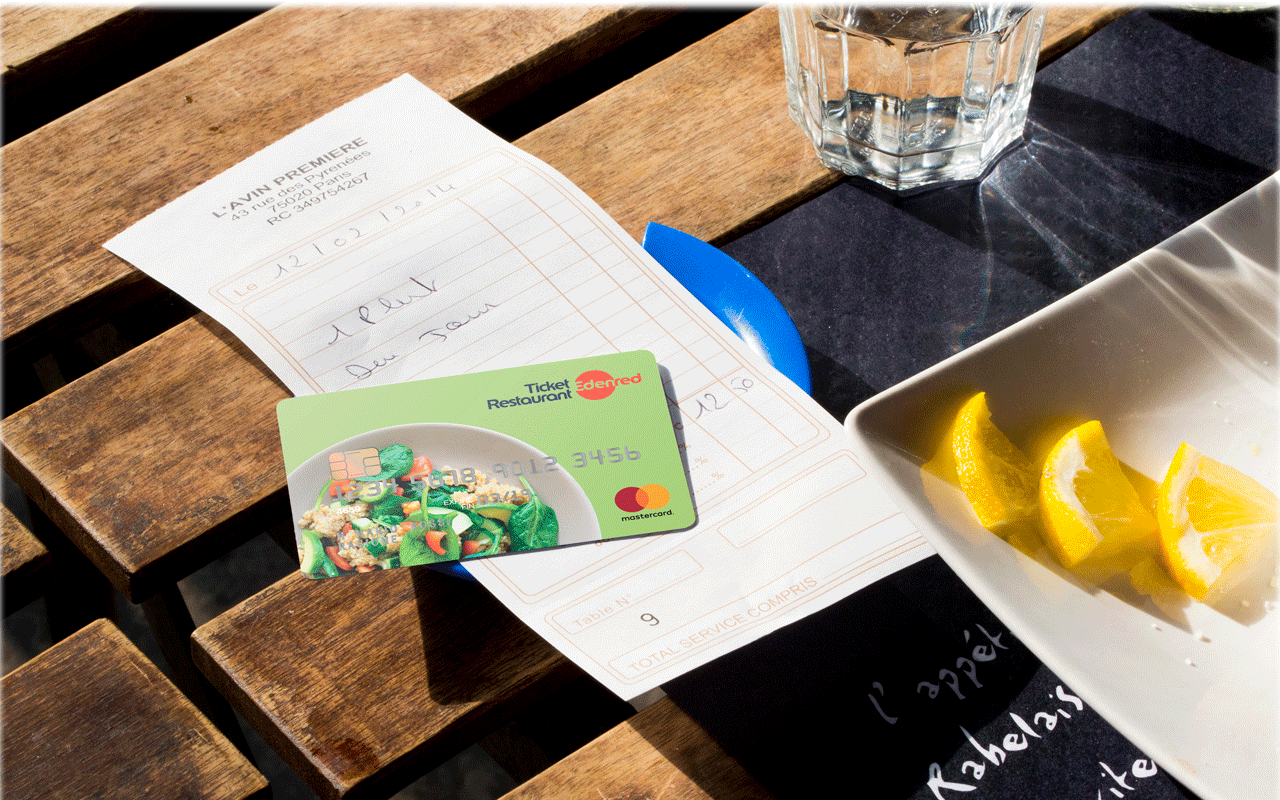

Le Fare Dodging: What a French lunch card says about the problems with TfL’s contactless payment system

Transport for London (TfL) staff were amazed when they noticed a new frontier in fare dodging: French tourists using workplace payment cards designed to give them discounted meals in bistros to travel for free on the London Underground.

The “titre-restaurant” or “ticket resto” cards are issued by French employers to millions of workers, enabling companies to sidestep the country’s strict labour laws on the provision of a staff canteen. The cards can only be used to purchase food in a limited number of outlets in France, whether that’s for a sit-down lunch in a restaurant or a subsidised trip to the boulangerie or supermarché.

According to an individual with direct knowledge of the situation, the problem at TfL was that groups of French tourists in London realised that their prepaid cards could be used to trick the Underground’s systems into letting them through barriers. When TfL’s system came to claim payment it was unable to retrieve the fare money from the “titre-restaurant” card operator. This is because the payment processor correctly noticed TfL was selling a tube journey around the British capital rather than a baguette in Marseille.

Much of the media narrative around fare dodging in the capital has focussed on people visibly pushing through barriers at stations in order to avoid paying. Conservative shadow justice secretary Robert Jenrick recorded a now-infamous viral video confronting people doing just this at Stratford station and presented it as evidence of the capital’s lawlessness.

What’s received less attention is the invisible abuse of the contactless payment system, sometimes by white collar workers who have found loopholes in the system used to process payments. This means that the person tapping out through the barrier in front of you could be fare dodger — but you’d never know it.

Multiple TfL staff who spoke to us described contactless payment fraud as a growing problem, fuelled by viral videos on TikTok, that could require a rethink about how the capital’s transport payment system works.

The main issue is that, unlike when making a purchase in a shop, Transport for London’s payment system doesn’t automatically collect money at the moment you tap out of a station. Instead, it totals up your fares at the end of the day, works out whether you have hit a daily cap, then bills your account.

This approach also ensures people can rapidly move through barriers in a fraction of a second rather than waiting for a payment to clear. Yet it has also led to stolen, cancelled, or frozen debit or credit cards being used to dodge fares.

In one instance earlier this year a person was caught using a defunct contactless payment card to evade paying the correct fare on 202 journeys, suggesting they were getting away with the crime for some time. According to the TfL, this individual was ultimately ordered to pay £1,472 in fines.

In another case, a man featured on a Channel 5 documentary was caught in a targeted operation by revenue protection officers after using a defunct payment card to travel around London for more than a year.

Without revealing the exact manner in which this works, London Centric was able to use a recently cancelled card to travel on the London Underground this week. That’s despite the same card being rejected for attempted payment in shops. (We had already paid for a separate, legitimate travel ticket.)

Attempts to repeat the process with a long-defunct credit card, however, failed and it was correctly identified by TfL’s barriers as being cancelled.

When London Centric used the Freedom of Information Act to request TfL internal data on the scale of contactless fraud and the methods used to check whether a contactless card has been reported as lost or stolen, the request was declined.

Transport for London acknowledged that releasing the information could be in the public interest but it ultimately decided this was outweighed by “the fact that publicising exactly what those controls are, and how successful they are, would run the risk of making those controls less effective, as people could use that knowledge to try and circumvent them.”

Separate sources at Transport for London suggested that many contactless payment cards have to be blocked manually, requiring time consuming work to identify misused contactless cards being used for travel around London.

A TfL spokesperson said fare evasion had already fallen to around 3.4% of journeys in the capital, arguing this was substantially lower than in comparable global cities such as New York. The organisation said they still want to reduce it further: “Fare evasion is not a victimless crime. It robs Londoners of vital investment in a safe, frequent and reliable transport network and we are committed to reducing the current rate of fare evasion to 1.5% by 2030.”

TfL said it is not aware of “widespread circumstances” in which French lunch cards were being abused while acknowledging a wider issue with such prepaid cards: “Should any prepaid card be used and no funds be able to be collected, we will look to block the card from our systems to ensure that they can not be used to defraud TfL. Anyone found defrauding the system by using such a card would be investigated by our Investigations Team.”

“We use advanced analytical tools, including TfL’s Irregular Travel Analysis Platform (ITAP) which uses ticketing and journey data, passenger information, and CCTV to identify persistent fare evaders whose pattern of evasion may not be visible but leaves a digital footprint on our network.”

The only flaw in this is if the visiting tourist has already returned to the land of discounted lunches.

When London Underground debuted its new ticket machines in the mid 80s, it didn't take long for teenagers to work out that wrapping a 2p coin with foil in such a way as to approximate the contours of a 50p piece would be accepted by the machine as a genuine 50p.

The flourish, however, was to buy an expensive weekly or monthly, load the machine with the dodgy coins, and promptly press cancel. The coin drums were giant carousels, and for every foil coin loaded at the top, a real one would be returned below. In this way it was easy to make upwards of thirty pounds at 1988 money, to sit in one's pocket alongside altered phonecards and voicemail retrievers.

Wonderful article dear boy, insightful and genuinely entertaining with it.

Without saying too much (and I do have professional experience in this area, and also retail POS), TfL chosen method of operations has traded reliability for valid card holders over declining invalid cards; and also simplicity of implementation, and minimisation of acquiring bank fees. The card schemes and acquiring bank capabilities were not designed to support this sort of transit ticketing at volume.

Could TfL achieve a better rate of accurate declines while maintaining reliable valid acceptances? Yes, with some additional development to detect intra-day cards that can't "settle" outstanding charges and add to block list. Without causing foreign tourists to be charged additional fees. This is not easy development to deliver at scale.

The acceptance of "restaurant" cards is however careless in my opinion; such cards are likely identifiable by the prefix of the card number (called the BIN, identifying issuing bank); the administrative challenge is keeping up with a changing list of cards issued for limited use purposes. TfL's acquiring banks should be assisting TfL's in house team (or Cubic) with that task.

I suspect the contactless card ticketing machines used on buses outside of London may have similar loopholes for similar reasons.